maryland digital ad tax effective date

Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. A study of the French digital advertising tax concluded that 55 percent of these advertising costs would ultimately be passed along to end consumers which if applied to the Maryland tax would result in more than 135 million of the revenue coming from Maryland consumers.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Tax imposed at rates of 2.

. The Comptroller of Maryland does not expect to issue additional guidance for the digital advertising services tax until at least July 2021. Maryland Digital Advertising Services TaxImplementation Delay Likely. The digitalization of the economy has proved to be a tough challenge for tax systems both globally and here in the United States.

Key aspects of Marylands new tax The newly enacted tax law defines digital advertising services to. Digital advertising taxes part 1. 732 imposes a tax on a persons annual gross revenues derived from digital advertising services in Maryland.

Digital Products and Digital Codes The new legislation excludes certain prerecorded and live instruction seminars discussions or similar events from the definition of a digital product. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. The bill would extend the effective date of the states digital advertising tax to tax years beginning after December 31 2021.

2 The regulations provide a. 732 on February 12 2021 making Maryland the first state in the country to adopt a tax on digital advertising. The current Maryland sales tax is narrow though attempts have been made to modernize the base.

Maryland has now enacted the nations first gross receipts tax targeted on digital advertising. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues.

On February 12 2021 the Maryland General Assembly overrode Governor Larry Hogans veto of HB 732 2020 the Act a bill enacting a first-of-its-kind digital advertising services tax on the. As mandated by the Maryland Constitution the tax will take effect in 30 days. Tuesday March 2 2021.

On the morning of Friday February 26 2021 the Maryland Senate Budget and Taxation Committee. The tax only applies to companies having annual gross revenues without deduction. The tax originally became effective for tax years beginning after.

Creates a new digital advertising gross revenues tax separate from and in addition to the existing sales tax. The state Senate Monday overwhelmingly passed SB. Senate Bill 787 was passed the Maryland Senate and been set for a hearing in the Maryland House Ways and Means Committee for March 25 2021.

Legal challenges have already been filed alleging that the new tax violates the federal Internet Tax Freedom Act PL. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. The tax is applicable to all taxable years beginning after December 31 2020.

Larry Hogans vetoes of a sweeping education bill and a first-in. The Maryland Comptroller later released Business Tax Tip 29 Sales of Digital Products and Digital Code which took an expansive interpretation of the law and. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue of internet advertising giants such as Google and Facebook Inc.

The French tax and Marylands proposed tax are not identical but. Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services effective March 14 2021. 105 - 277 and the US.

On February 12 2021 the Maryland General Assembly overrode Governor Larry Hogans veto of HB 732 2020 the Act a bill enacting a first-of-its-kind digital advertising services tax on the annual gross receipts from the provision of digital advertising services in Maryland. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan. Of February 12 2021 is later than the effective date of July 1 2020 HB 732 now becomes effective March 14 2021 and appl ies to taxable years beginning after December 31 2020.

Maryland lawmakers Friday overturned Gov. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. Tax imposed on a persons annual gross revenues derived from digital advertising services in Maryland.

Maryland to implement digital ad services tax. As mandated by the Maryland Constitution the tax will take effect in 30 days. Requiring the Governor to include at least 18250000 in the annual budget for fiscal year 2022 and each fiscal.

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. The statutory references contained in this publication are not effective until March 14 2021. Weve talked a lot about the OECDs efforts to update the international tax system and to limit the impact of unilateral digital services taxes.

The new tax on revenue earned from digital advertising applies a graduated rate based on the taxpayers global annual revenue. Effective for tax years beginning after Dec. Imposing a sales and use tax rate of 12 on electronic smoking devices.

Tuesday March 2 2021. Feb 12 2021 at 628 pm. Taxation Tobacco Tax Sales and Use Tax and Digital Advertising Gross Revenues Tax.

Increasing certain tax rates on cigarettes and other tobacco products.

How To Submit Bluehost Affiliate Tax Form For Indian Residents Royal Ecash Bluehost Affiliate Tax Forms Bluehost

Top 10 Tax Tips For The Self Employed Already Know But This Is Handy Bookkeeping Business Small Business Bookkeeping Business Finance

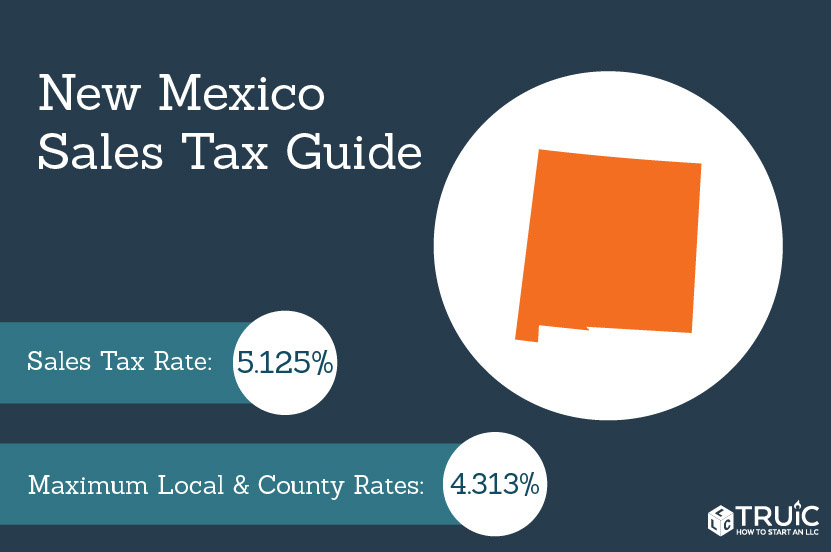

New Mexico Sales Tax Small Business Guide Truic

Pin On Create Digital Signature Online

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

13 Key Financial Terms Every Business Owner Should Know Business Financial Key Owner Terms More A In 2022 Accounting Services Business Tax Business Bank Account

Knowledge Management Process Bing Images Data Mining Technology Careers Knowledge Management

10 Effective Types Of Explainer Videos Explainer Videos Corporate Videos Animation Explainer Video

Smile Digital Print Print At Home Digital Art Dentist Etsy Dental Fun Facts Medical School Inspiration Digital Prints

Top 10 Tax Tips For The Self Employed Already Know But This Is Handy Bookkeeping Business Small Business Bookkeeping Business Finance

Client Feedback Is Important To Us Here Is One Of The Feedback That We Have Received From A Client Clientf Accounting And Finance Informative Tax Accountant

Managing Your Inventory Inventory Management Techniques That Keep You From Losing Money Clickfunnels Management Techniques Inventory Management Software Inventory Management

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Sears Phd Of Social Media Explains How Brands Can Create Orbits To Pull In Customers Social Media Explained Social Networks Customer Loyalty Program

Family Practice Management Superbill Template Practice Management Management Family Practice

Maryland Crop Share Rent Farm Lease Form Download Free Printable Legal Rent And Lease Template Form In Different Edi Crop Insurance Legal Forms Legal Contracts

Maryland Digital Advertising Tax Regulations Tax Foundation Comments